Amendments to the Patent Rules were published on June 21, 2023,

revising the tariff of fees payable to the Canadian Patent Office, and broadening the small entity definition. The changes take effect on January 1, 2024. Applicants and patentees

can pay future official fees now, at the lower 2023 rates, before the fee increases take effect. However, applicants and patentees having 51-99 employees may wish first to assess whether they will newly qualify as small entities as of January 1, 2024.

In separate legislation, trademark and industrial design fees will also increase as of January 1, 2024.

Table of contents

- Official fees increasing up to 36% in 2024

- More applicants and patentees may qualify to make small entity payments

- Recommendations to applicants and patentees

- Some historical background to patent fee revisions

Official fees increasing up to 36% in 2024

This will be the first comprehensive revision of the tariff of fees in 20 years. The revisions aim to increase most fees by 25%, without adjustment of small entity fees. However, because many fees payable to the Canadian Intellectual Property Office (CIPO)

have recently become variable on an annual basis under separate legislation to account for inflation, and recent inflation has been high, the actual fee increases for 2024 will range anywhere from 0% up to 36%.

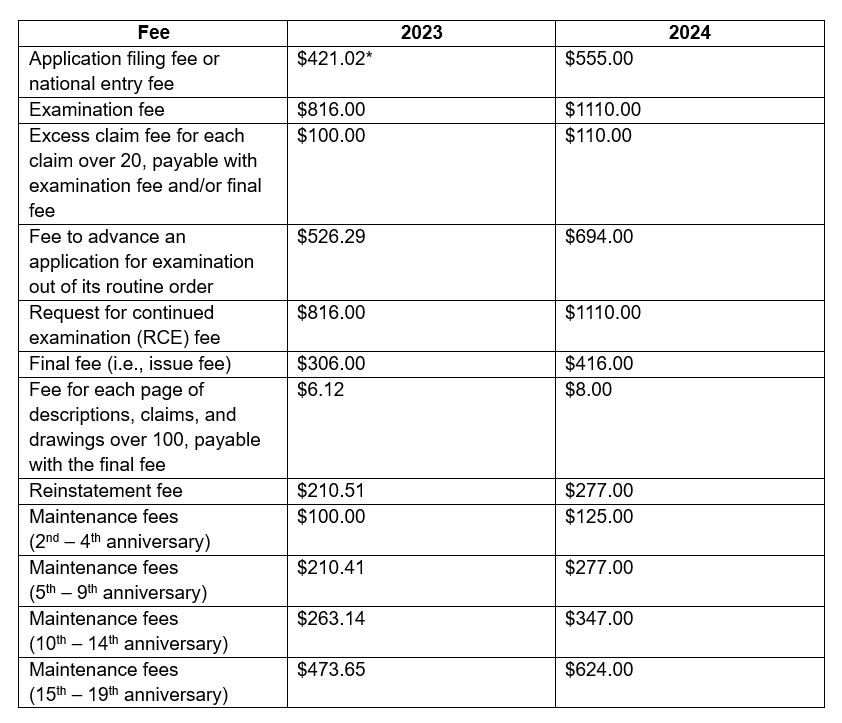

Changes for commonly paid fees include the following:

*All fees CAD and shown at the standard entity undiscounted rate.

For a complete schedule comparing the current fees and the 2024 fees, please see this link.

As noted above, fees due in 2024 or later may be paid at the reduced 2023 rates if paid before January 1, 2024.

More applicants and patentees may qualify to make small entity payments

Many CIPO fees for patent applications and patents are discounted by 50% if the “small entity status condition” is met for an application or patent.

Currently, the small entity status condition is that:

(a) in respect of an application for a patent — other than a PCT national phase application or a divisional application — the applicant of the application on the filing date is, on that date, an entity that

has 50 employees or less or is a university, other than

(i) an entity that is controlled directly or indirectly by an entity, other than a university, that has more than 50 employees, or

(ii) an entity that has transferred or licensed, or has an obligation other than a contingent obligation to transfer or license, any right or interest in a claimed invention to an entity, other than a university, that has more than 50 employees;

(b) in respect of an international application, the applicant of the application on the national phase entry date is, on that date, an entity that has 50 employees or less or is a university, other than

an entity referred to in subparagraph (a)(i) or (ii); and

(c) in respect of a divisional application, the applicable requirements of this provision are met in respect of the original application.

As of January 1, 2024, the above entity size is increased from an entity that has 50 employees or less to an entity that has fewer than 100 employees. In other words, small entity status is changed to cover entities having 51-99 employees.

It appears that the changes are in a sense retrospective,1 such that, if the applicant had more than 50 but fewer than 100 employees at the time of filing or national entry

and the small entity condition was not met before the rule change, on or after January 1, 2024 it will nevertheless be possible to start paying small entity fees in the application or patent.

By way of example, if an applicant having 75 employees files a Canadian patent application or enters the Canadian national phase on August 8, 2023, the small entity condition will not be satisfied (the applicant has more than 50 employees) and the filing

fee must be paid at the standard entity rate. But as of January 1, 2024, under the new definition, the small entity condition was satisfied at filing (i.e. the applicant had fewer than 100 employees on August 8, 2023), so future payments may be made

at the small entity rate.

A “small entity declaration” must be filed before small entity fee can be paid, so the applicant in the above example would have to file a small entity declaration on or after January 1, 2024 in order to pay small entity fees in the future.

A refund of the difference between the standard entity fee and small entity fee for fees paid at the standard entity fee before a small entity declaration is not available.2 Therefore, in the above example, the applicant would not be entitled to a refund of 50% of the standard entity filing fee paid on August 8, 2023, prior to the change in the small entity definition.

In sum, the effect of the change in the small entity definition is that, as of January 1, 2024, if the original applicant at the time of filing or national entry had fewer than 100 employees

(and the other small entity conditions were met), it is possible to start paying small entity fees once a small entity declaration is filed.

Counterintuitively, small entity status attaches to the application or patent, not the applicant or patentee, and is determined only once, at the time of filing or national entry. If an applicant that is a small entity at filing later grows to have more than 99 employees or assigns the application to a company with more than 99 employees, it remains possible to pay small entity fees for the life of the patent. Conversely, if a multi-national company files a patent application and later assigns the application or patent back to the inventor, the inventor must pay standard entity fees for the life of the patent, because the small entity condition was not met at the filing date.

Recommendations to applicants and patentees

Paying fees early

As a cost-saving measure, applicants and patentees may wish to pay upcoming fees before the fees increase on January 1, 2024. Fees that reasonably might be paid early include at least

the following:

- Maintenance fees – Any number of future annual maintenance fees could be paid in 2023.

- Examination fee – If the Canadian (PCT) filing date is before October 30, 2019, the examination fee must be paid within five years of the filing date. If the Canadian (PCT) filing date is on or after October 30, 2019,

the examination fee must be paid within four years of the filing date. In any case, the examination fee may be paid earlier.

- Divisional applications – The greatest savings may be realized in divisional applications. All past-due maintenance fees from the second anniversary onward are payable when a divisional application is filed. In most instances,

the deadline for requesting examination will be three months from filing. Of course, the filing fee must also be paid. The government fees payable with a divisional application may therefore be substantial. If a divisional application will ultimately

be filed, costs will be reduced by filing it in 2023.

Reviewing small entity status

The increase in the size of an eligible small entity from 50 to 99 employees may permit small entity fees to be paid where this previously was not possible. As discussed above, the change applies only to fees paid on or after January 1, 2024 and requires

submission of a small entity declaration.

In a few instances, the change in the small entity definition could warrant deferring rather than advancing payment of a fee. For example, if small entity status will be acquired as of January 1, 2024, an applicant may prefer to wait until January 1,

2024 to file a small entity declaration and pay the examination fee at the small entity rate, rather than pay the examination fee at the 2023 standard rate.

As the assessment of small entity status can be involved, applicants and patentees should obtain advice from their Canadian patent agent prior to claiming small entity status.

Some historical background to patent fee revisions

To the uninitiated, the annual changes to CIPO fees will be perplexing. For instance, in each year from 2004 through 2020, the patent application filing fee was $400. In 2021, the filing fee increased to $408 but then fell in 2022 to $407.18. In

2023, the filing fee rose again, this time to $421.02. For 2024, the fee will be $555. Why? At least part of the answer lies in separate federal legislation governing fee-setting procedures.

The Federal User Fees Act was enacted in 2004, setting out burdensome requirements to be met for a regulatory authority to establish or increase a government fee. Before establishing or increasing a fee, the CIPO had to:

- notify clients and other regulating authorities with a similar clientele of the user fee proposed to be fixed or increased;

- give all clients or service users a reasonable opportunity to provide ideas or proposals for ways to improve the services to which the user fee relates;

- conduct an impact assessment to identify relevant factors, and take into account its findings in a decision to increase the user fee;

- explain to clients clearly how the user fee is determined and identify the cost and revenue elements of the user fee;

- establish an independent advisory panel to address a complaint submitted by a client regarding the user fee or change; and

- establish standards which are comparable to those established by other countries with which a comparison is relevant and against which the performance of the regulating authority can be measured.

In addition, the federal government Minister responsible for CIPO was required to table a proposal in Parliament:

- explaining in respect of what service, product, regulatory process, facility, authorization, permit or licence the user fee is being proposed;

- stating the reason for any proposed change in user fee rate;

- including the performance standards established as described above and the actual performance levels that have been reached;

- giving an estimate of the total amount that will be collected in the first three fiscal years after the introduction of the user fee, and identifying the costs that the user fee will cover; and

- describing the establishment of an independent advisory panel as described above and explaining how any complaints received were dealt with.

Finally, if the proposed fee was higher than that comparable fee in other countries, the Minister had to give reasons for the difference.

The daunting work required under the User Fees Act to adjust a fee may have contributed to the lack of CIPO fee increases since 2004.

The User Fees Act was repealed in 2017 and replaced by the Service Fees Act. The Service Fees Act reduced the complexity of the fee-setting process but introduced two new requirements: (1) automatic annual adjustment of fees;

and (2) a requirement for remission of fees if a performance standard is not met.

Under the Service Fees Act, fees are adjusted in each fiscal year—on the anniversary of a date that is selected by the responsible authority with respect to the fee before the first adjustment—by the percentage change over 12 months

in the April All-items Consumer Price Index for Canada, as published by Statistics Canada under the Statistics Act, for the previous fiscal year. As the Consumer Price Index increases or decreases each year, CIPO fees (other than “low

materiality fees” of less than CAD $150) rise and fall automatically, in non-rounded amounts. This explains why the application filing fee varied by small amounts in 2021, 2022, and 2023 as described above. A similar automatic adjustment will

apply to all fees other than low materiality fees again in 2025.

The Service Fees Act requires federal government authorities such as CIPO to set service standards for providing a service in return for a fee in consultation with interested persons. If a service standard is not met, CIPO must remit the portion of the fee that CIPO considers appropriate to the applicant or patentee. For example, the current service standard for granting a patent after payment of the final fee (i.e. issue fee) is 16 weeks. If the service standard is missed by 50% or less, 25% of the fee paid will be remitted. If the service standard is missed by more than 50%, 50% of the fee paid will be remitted.3

If you have questions or require further information, please contact a member of the Patents group at Smart & Biggar.

The preceding is intended as a timely update on Canadian intellectual property and technology law. The content is informational only and does not constitute legal or professional advice. To obtain such advice, please communicate with our offices directly.

References

1. The definition of the small entity condition in section 44 of the Patent Rules has been replaced with a new definition, also reading in the present tense. There are no transitional provisions. Notably, the amendments as enacted do not include a provision (new section 224.1) contained in the original version of the rules as published for consultation in Canada Gazette, Part I, Volume 156, Number 53, on December 31, 2022. Proposed section 224.1 would have retained the 50-employee limit for small entities for applications filed or entering the national phase before January 1, 2024. Moreover, section 10 of the Interpretation Act provides that “The law shall be considered as always speaking, and where a matter or thing is expressed in the present tense, it shall be applied to the circumstances as they arise, so that effect may be given to the enactment according to its true spirit, intent and meaning.” Section 12 provides that “Every enactment is deemed remedial, and shall be given such fair, large and liberal construction and interpretation as best ensures the attainment of its objects.”

2. Section 139 of the Patent Rules provides a comprehensive closed list of the fees that may be refunded and does not include fees paid at the standard fee level when the applicant or patentee would be entitled to pay fees at the small entity level. Paragraph 139(1)(h) does permit a refund of “any overpayment of a fee.” However, payment of a fee at the standard entity level before filing a small entity declaration is not considered an “overpayment.” See §10.02.02 of the Manual of Patent Office Practice confirming that “If a small entity declaration is submitted after a standard fee is paid, but before the fee-payment deadline, the standard fee payment will not be considered an overpayment and a refund of the difference between the standard and small fee amounts will not be provided for that particular payment.”

3. See https://ised-isde.canada.ca/site/canadian-intellectual-property-office/en/corporate-information/performance-targets/client-service-standards for a complete list of CIPO service standards.

Related Publications & Articles

-

Federal Court confirms test for leave to file new evidence in appeal from Opposition Board Decision

As of April 1, 2025, subsection 56(5) of the Trademarks Act requires parties to obtain leave to file additional evidence on appeal from decisions of the Registrar of Trademarks (the “Registrar”), whic...Read More -

Top five 2025 trends in Canadian copyright law

2025 saw incremental developments in Canadian copyright matters anticipated to set the foundation for potentially major changes in the coming years in AI and accessible remedies for infringement and h...Read More -

Patenting AI: Shift the focus to do it better

Patent protection is pursued for all types of technologies. Why should anything be different just because the technology is based on artificial intelligence (AI)? Nothing is different when reduced to...Read More